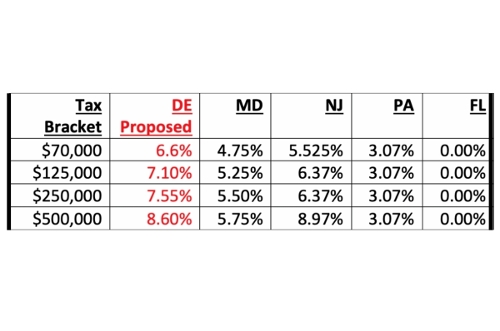

All higher-income Delaware households would save income tax payments by moving to Maryland and New Jersey, except households with income of $500,000 or more moving to New Jersey. In 2018-19 New Jersey had the fourth-highest net domestic out-migration rate in the nation, and over the last 25 years, New Jersey has had net out-migration of over $41 billion of adjusted gross income.

With the high likelihood of a large cash infusion shortly, maybe it's time to LOWER THE PERSONAL INCOME TAX RATE.

A 17% rate cut brings down the top 6.6% rate to 5.5% suggests a revenue shortfall of $270 million. But history shows that revenues will increase.

(*Disclaimer: For more information on how the tax rates will affect you personally, please consult your accountant.)