|

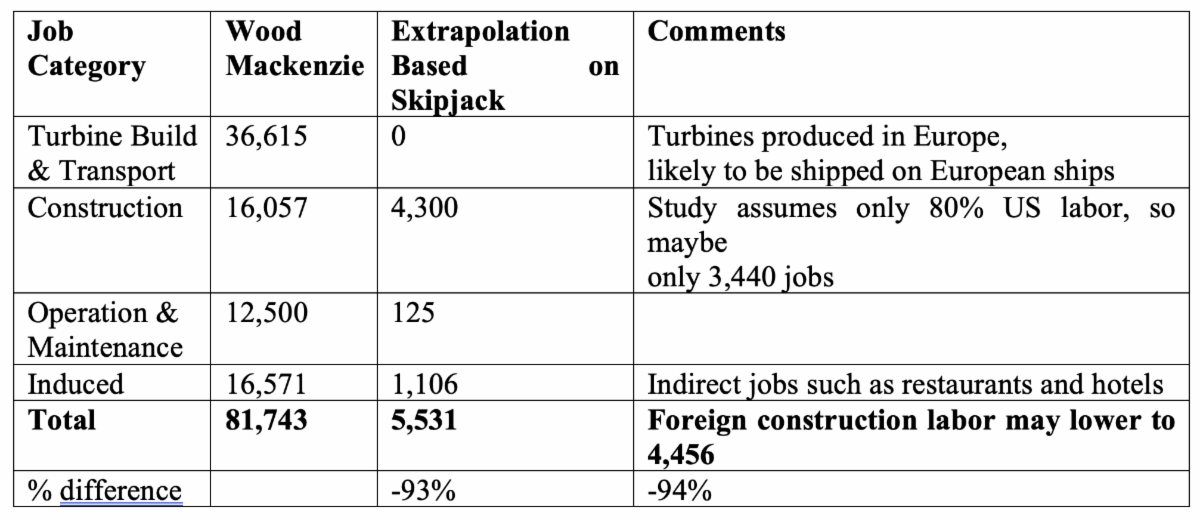

There are limited plans to build the turbines in the US, which accounts for 56% of the forecasted jobs. Induced jobs are indirect jobs created by the wages spent by direct employees and change as payroll estimates change.

The Wood Mackenzie study assumes that over half the new projects would be off the Carolinas. However, any new project needs massive state subsidies, and neither North Carolina nor South Carolina has such legislated mandated subsidies.

Money spent on higher utility bills reduces spending on everything else, like going to a restaurant or the movies.

The Skipjack project premiums[ii] will be passed onto electric customers and may average $125/MWh for the 3.3 million MWh of wind energy produced each year, or about $410 million a year. That extrapolates to $2.05 billion a year for the 4,200 MW construction the study expects. A job may be lost for every $80,000[iii] spent on higher electric bills, so up to 25,600 jobs may be lost.

Wood Mackenzie is generally reliable, but this study misses by a country mile and is misleading elected officials and the public.

* * *

[i] Maryland Public Service Commission Docket 9666, item 33, ICF International "Evaluation and Comparison of Marwin II and Skipjack Wind proposed offshore wind project applications" Exhibits 56 and 59.

[ii] ORECs represent the premium price paid for the Skipjack offshore wind power. Ørsted has reported on an OREC cost of $71.61/MWh, but this is in 2012 and is subject to a 3% a year increase for twenty years once the project starts, Ørsted media announcement.

[iii] The Balance, "Do Tax cuts create jobs" payroll tax data shows a job gained for each $76,923 in tax cuts ($1,000,000 =13 jobs); Beacon Hill Institute, "The proposed Massachusetts carbon tax; a high-cost low benefit policy" Table 4 shows investment would fall $925 million and reduce jobs by 11,090 = $83,408 jobs.

|